Prepare to Buy Your First Home in 4 Steps

Are you ready for this race?

If you're reading this, you've probably been thinking about becoming a homeowner for a while. You may have already gone to some open houses, thought about what it means to own a home, and read a few articles about home loans.

This is an enormous decision so most people tend to take a little time to warm up to the idea. It's pretty rare that someone walks into an open house, looks around, and decides to buy it spur-of-the-moment. Although that does occasionally happen, houses aren't usually an impulse purchase!

Let's look at some steps you can take to feel confident about diving into huge debt... oops, I mean, becoming the owner of a fabulous home!

STEP 1: KNOW THYSELF

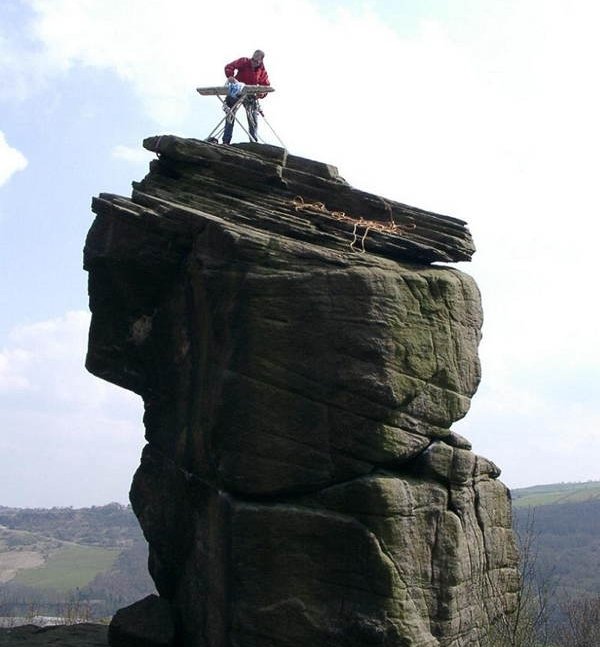

It's important to live near your regular "Extreme Ironing League" meetings. (Yes, this is really a sport.) Source: Wikipedia

It's a good idea to home in on what you want before casting an impossibly wide net for your search. Think about your preferences for: location, size, age, lot size, levels, garage, view, number of beds/baths, style, property type (condo/townhouse, attached, detached, or something else), etc.

Housing, like relationships, can be low-maintenance or high-maintenance. How much work are you really willing to take on? Are you someone that likes to spend your downtime in leisurely activities or are you a high energy, "work hard, play hard" sort of person?

The answer to that question can help determine what type and age of home you should look at, what size of yard would be appropriate, and even length of distance from your workplace, schools, and other places where you spend a lot of time.

Be honest about how much effort (and money) you want to put into repairs, upgrades, and maintenance. Maybe you've been eyeing those gorgeous, craftsman-style older homes when a condo or newer attached home with a small yard would be a better fit.

Read my blog about Buying New Construction if you are considering a brand new home.

Be realistic about how far you're willing to drive and whether or not you will regularly use mass transit. Maybe that new construction home in Bethany seems perfect for you, but realistically you don't want to drive all the way to Oaks Park 5 times a week for your Roller Derby practices.

STEP 2: KNOW THY CREDIT SCORE

Please don't apply for a bunch of credit cards or vehicle loans right before you want to buy a house...

How's your credit report and credit score? If you're not sure, then it's time to check them.

You can access your credit report from the 3 major credit reporting agencies for free once every year, but this will not include the actual credit score. Go ahead and pull the free reports from Annualcreditreport.com. Look over all the credit information to make sure there are no mistakes that need to be corrected.

But, you need to pull your credit score, too.

You can get your credit score by signing up for the different monitoring services available through TransUnion, Equifax, or Experian. They usually allow for a trial that you can quickly cancel after you get your score. These will probably pop up as options after you fill out your details and receive your free credit reports from Annualcreditreport.com.

There are other ways to access your credit score that don't require signing up for a monitoring service. This article from the Consumer Financial Protection Bureau details some of those methods.

STEP 3: KNOW THY FINANCES

My preferred lender.

This is about more than just getting pre-approved for a home loan. What you qualify to borrow and what you're comfortable with borrowing are likely two very different numbers.

If you haven't chosen a lender yet, this is a great way to find one that is willing to go the distance for you. Find a loan officer that will talk to you about mortgage rates, terms, and payment amounts. The loan officer should be able to put together some scenarios for you and break down the details of the monthly payments. (PITI is a good term to learn - this is the sum of the mortgage payment including: principle, interest, taxes, and insurance.)

I have some excellent recommendations for loan officers. Contact me if you'd like me to refer you to a great lender.

In addition to understanding loans and payments, consider how much money you have in savings. Completely draining most of your savings in order to make a down payment on a home is not recommended. Not only will you quickly become "house poor", but you will also be placing yourself in financial risk.

Even when buying a home, leave a cushion for emergencies. They can happen at any time!

At the same time, don't assume that you need 20% down to buy a home. There are a lot of different loan products out there, and maybe even options where you can place less than 20% down and still not pay extra PMI (private mortgage insurance). A good loan officer will help guide you.

STEP 4: KNOW THY REALTOR

Just my picture, hanging out in the section about choosing a Realtor...

Choosing a Realtor is often the last thing that people do before they start a serious home search. But, if at all possible, try to choose a Realtor before you're ready to officially start looking.

Finding the right Realtor should be a lot like recruiting an employee because that's basically what they are. If you can, take the time to sit down with any Realtor you think has potential. Hopefully, they will have some sort of presentation (it doesn't have to be super long, but if they're serious about wanting to represent you, they should bring something to the table).

Then get to know them. Ask them about their background and how they can help you throughout the process. Feel free to let the conversation roam to things you have in common, hobbies, history, etc. This is someone that you may be spending a lot of time with as you look at homes.

There are a few key things you should be trying to figure out as you talk to Realtors:

Do they have time for your business? Realtors, like all salespeople, have a hard time saying "no" to new business, even when they don't really have time to take on more clients. Ask them about how many people they are representing. Don't assume that they will have time for your business because you met them at an open house. Give them your contact information and see if they follow up with you (ideally more than once). If they do, there's a good chance that they really want your business and will give you the time you need to find a home and successfully work through the transaction.

Are they always available? Are they a full-time Realtor or is this a part-time job for them? Do they work on a team? If so, who are the team members and who will you actually be working with? Real estate is not a 9 to 5 job. It's a 24/7 business! A part-time Realtor will not be able to immediately respond to inquiries and issues. This can hamstring your search and cause enormous problems during a transaction. Teams can be a good or bad thing, depending on the team. If the Realtor is part of a team, insist on meeting all the people that you will be working with.

How are their communication skills? Poor communication is one of the most frequent complaints people make about Realtors they've worked with in the past. Make sure they are articulate, but have good listening skills. Are they able to handle interruptions? Are they confident? Are they following up with you in a timely manner? Are they tech-savvy?

Do you trust them? Trust is absolutely key in choosing a Realtor. How many homes they sell, how well they dress, what kind of car they drive, and even years of experience doesn't tell you anything about how good they are at representing their clients. Trust your instincts here.

I wrote a blog about Commissions that is focused on the listing side of real estate. It's a good idea to read about selling a home so that you can gain a better understanding as a buyer of how the process works. I also have more advice in there about choosing a good Realtor.

Something to remember: As a buyer, you will almost never need to pay for your Realtor's commission. That is almost always decided and paid by the person selling the property. You can read the blog about commissions to learn more about how this works.

I also wrote another blog you should check out: Tips for Home Buyers. This dives into some aspects of buying real estate not covered in the current post, such as: understanding your market, resale value, and having a good support system.