Heavy Duty Pre-Fall Portland Real Estate Market Report

Just in time for (almost) autumn, let's take a look at what's really happening in the Portland metro area. This is a big report, so go grab a pumpkin spice latte and let's get to it!

Change makes market reports fun!

We've been suffering (or enjoying, depending on your point of view) from a very low inventory residential real estate market for years. This has been great for home sellers that weren't also looking to buy, but not so great for home buyers, especially first time home buyers. It hasn't been fun for renters, either.

Well, the times they are a-changin'. But, maybe not as much as some headlines might have you believe... Let's take a reasonably deep dive into what's going on.

First, we'll look at the state of affairs, then we'll dive into what might be causing the shift and how it might effect you.

How are we doing on inventory?

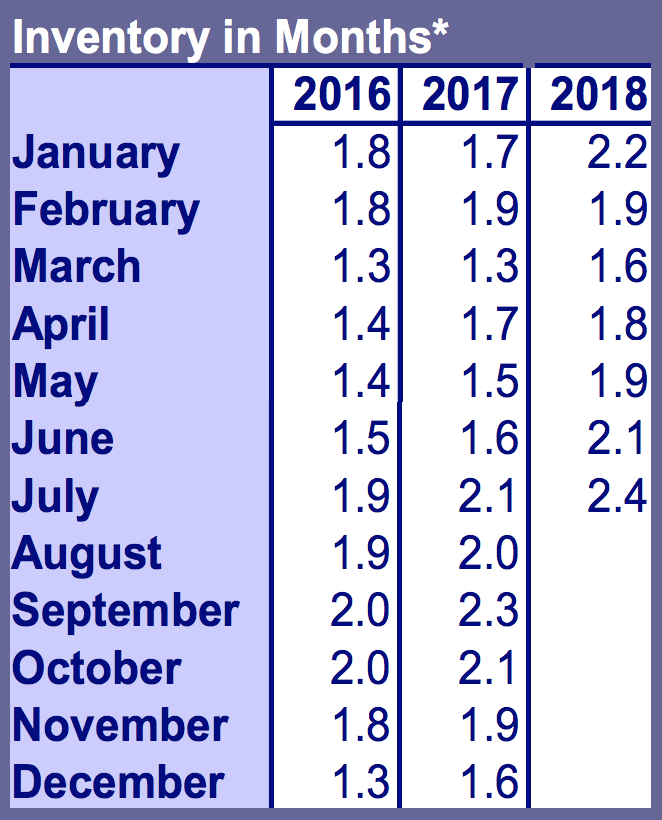

*Inventory in Months is calculated by dividing the Active Residential Listings at the end of the month in question by the number of closed sales for that month. This includes proposed and under construction homes.

Source: RMLS

As you can see in the chart, we have more inventory now than we've had in years. While it's been ever-so-slowly edging up for the past year or so, appreciable gains have only really been felt over the last 3 months.

However, 2.4 months of inventory does not a buyer's market make. Traditionally, 5-6 months of inventory is considered a "balanced" market. Less than that is considered a seller's market.

I'm not sure if traditional definitions are going to hold out, though. Inventory in months doesn't take volume into account. It just looks at the number of active listings and then divides that by the number of closed sales for that month.

For example, if there were 10,000 homes active on the market with 2500 homes closed during that month, you'd have 2.5 months of inventory. But, if only 1000 homes are on the market and 250 homes close, you'd still have 2.5 months of inventory...

Inventory in months is only one statistic. If the volume of listings is low (and it has been for awhile), it can certainly deter some buyers from getting serious about finding a home. Years of low inventory, along with other factors, have led many prospective home buyers to stay put. Because of that, I think that even a modest rise in inventory will make the market act and feel more like a buyer's market (at least for a little while).

Okay, so inventory has gone up a little, what's going to happen to home prices?

This is the multi-thousand dollar question! I'll go ahead and put my soothsayer hat on... okay, there we go.

There is little doubt that we are in a market that is very different from what's been going on for the past several years. Double digit year-over-year price gains are probably a thing of the past until the next big housing push. I also no longer experience "bidding wars" (with one recent exception on a super cute home in Hillsboro).

The Portland metro area as a whole has seen a 6.4% increase in prices when comparing rolling 12 month periods ending in July. That means the sale prices are pulled from 8/1/16-7/31/17 and averaged ($416,000), then pulled from 8/1/17-7/31/18 and averaged ($442,800), then the two figures are compared to land at that 6.4% figure. (Source: RMLS Market Action Report, July 2018)

Because we're comparing rolling 12 month periods, and the fact that the shift we're experiencing only really began in mid-spring, it means this price increase figure lags well behind the market. Most homeowners aren't seeing that kind of appreciation right now, and it's unlikely that they will going into next year.

Also, we have to consider what I term "micro-markets". A 325K attached home in Beaverton/Aloha is not performing the same as a 550K condo in the Pearl District, which isn't performing the same as a 900K detached home in Southeast Portland.

As volume of sales diminishes and inventory goes up, condos and higher priced homes are feeling much more pressure than single family detached homes in the more affordable price ranges (roughly speaking, "affordable" refers to below 500K or so in most of Portland and below 400K or so in the suburbs).

The number of condos on the market right now is much higher than demand. It's been a pretty rapid rise and we're at a point that I would say that condos are now a buyer's market. Condo owners are likely to see a small to moderate dip in value over the next year.

This isn't necessarily surprising, especially with all the new apartments being completed and rents stabilizing (and in some cases decreasing). Condo buyers are often investors or former renters. Unfortunately, the cost of homes in Portland compared to potential rent income doesn't make much sense to investors any longer, so that buyer pool has diminished. Condos also feel the effects of a downward market shift more than any other segment.

High priced homes are feeling the pinch, too. Due to the rising costs of labor and materials, home builders are primarily focusing on building larger, higher priced homes in order to limit their cost per square foot. The amount of inventory coming online is, frankly, a little daunting. Demand for homes, especially at 800K+ (often called "luxury homes") just can't keep up with the inventory. I expect luxury homes to see a small decrease in value over the next year.

But, before you think that I'm spelling gloom and doom, be assured that the housing market and home prices as a whole still look stable. Affordable "starter homes" are still in high demand while mid-priced homes that are in good condition seem to still be moving at a good pace. In many ways, the current market is a return to sanity. I expect that the majority of detached, single family homes will continue to see small to moderate increases in value over the next year.

Of course, all of the above predictions are general in nature. There is only ever one true value of a home: what a buyer will pay for it. Every home is different and there are many different factors that contribute to value.

Keep in mind that we just wrapped up one of the slowest months of the year (August). Oregonians don't like home shopping in summer. There are much more fun things to do before Back to School time! We should all keep a very close eye on what happens in September and October.

Inventory is going up, prices are either going up, down, or flat... What's causing all this change?

In short, I think the biggest factor is the cost of housing versus income.

Something's always gotta give, right? Wage growth simply hasn't been keeping pace with the cost of living, and housing costs are a big part of that. While buying a home is a good decision for many people, it's rarely a way to save money.

At some point, the rising cost of housing reaches a tipping point where current home owners and renters decide that staying put makes more sense than buying.

BTW - I am not one of those Realtors that will say, "Anyone that can become a homeowner should!". The fact is, home ownership isn't the right thing for everyone. It's always situational, and it always depends on why you want to buy a home, where you're at financially, what's important to you, and whether or not you have the time and resources to dedicate to the process. But, I digress, because this could be a whole other blog topic...

Other factors:

Jobs

Unemployment is very low all over the country, and Portland is no exception. However, the tech industry was one of the big drivers that helped dig Portland out of the recession (and fairly quickly, too). But tech employment has slowed considerably over the last couple of years. Our job market simply isn't robust enough to fuel our seller's market forever.

Mortgage rates

Rates for a 30 year mortgage were around 3.5% for some borrowers a couple of years ago. Now they're around 4.5%+ for some people. (Lots of factors influence rates. Check with your lender or contact me for a referral if you would like to find out what you can afford.)

Rates have gone up enough that people who already own homes have to consider the rate and term they would lose if they were to sell. That digs into their buying power, and may not make it worth it to sell their current home and buy the one they want. Instead, many people are choosing to remodel.

Coincidentally, I wrote a blog a year ago about deciding to buy-up or remodel. It's still a good read today!

While rates are a factor for current homeowners thinking about buying-up, they aren't anywhere near high enough to truly deter first time home buyers, investors, and people looking for second/vacation homes. And many people are choosing to keep their current home, turn it into a rental, and buy another home. This is a great market for that!

Fortunately, since a scary spike near the beginning of 2018, rates seem to have mostly leveled off, at least for the moment, though whether or not they go up or down in the near-term is impossible even for experts to predict. It's very uncertain due to...

The Market as a Whole

Consumer confidence (which is still high right now), intermittent fears of a recession, trade wars, uncertainty regarding the Fed, another day of the stock market closing near record highs (how long will this last?), and, you know, all that political stuff going on, among other things.

The old saying is that fear and greed drive the market. When fear or greed spikes, markets can do crazy things. The housing market has been running on a form of tempered greed for a while now, but no one wants a return to 2008. I think everyone is still hanging onto a healthy amount of fear, and that is also fueling this market shift.

What does all this mean for potential home buyers and sellers?

In short, it means keep living your life, consider your options, and talk to trusted professionals if you're considering a big decision like buying or selling a house.

There is a lot of home buying and selling going on right now. We all have to keep in mind that market shifts are normal and occur all the time in real estate. Check out this graph generated back before the recession: A History of Home Values. And here's an article with a chart of home values up to 2018 (from the S&P CoreLogic Case-Shiller Indices). Notice how many "fits and dips" occur in these charts.

The "cooling off" (that's how a lot of the media refers to it) that we're seeing is really not surprising given how long we've seen these rapid price increases.

It doesn't mean that the sky is falling, that we're headed into another recession, or that all real estate activity is coming to a screeching halt. There are lots of first time home buyers entering the market, plenty of people that are deciding to upsize or downsize, people moving in from out of state looking for a home, investors still finding deals, people still flipping houses, etc.

It does mean that the strategy that I employ to sell a home is adjusting. It means that there may be a few more options for my buyers, and a little more negotiation room (depending on the property). It means that sellers have to be more realistic in their goals and buyers might have a little more breathing room to make decisions.

It does mean that if you are considering selling, especially if you own a condo or higher priced home, then the best time is now.

It does mean that if you are considering the purchase of a condo, that we should take a careful look at the specific areas and price range that you are interested in, and determine what the inventory looks like and how good of a deal it would need to be. (The inventory is high enough that there will definitely be some deals to be had!)

It does mean that if you are considering purchasing a home over 800K... um, just call me and let's find something incredible, mmmkay? :)

It does mean that if you are considering buying a home (especially a detached home) anywhere near the more affordable ranges (let's just say under 800K to be safe), that now is still very much a good time, as it is likely that many homes in this category will continue to see some price appreciation, and rates will also likely continue to rise over time.

Price appreciation and rising rates will slowly erode affordability, so waiting to save a little bit more money for a down payment may actually end up costing you money. If you don't believe me, speak to a trusted lender and they'll look at the figures and pencil it out. Contact me and I can also refer you to a few good lenders that I know.

Summary

Things are changing but the sky isn't falling. A shifting market often means good opportunities in real estate! Not everyone has their finger on the pulse. If you are thinking about buying and/or selling, let's talk about your situation and figure out if now is the right time to move forward.

If you are worried about a return to pre-2008 times, here is a good article that takes an in depth look at the question "Is the Real Estate Market Going to Crash?". Lots of factors are influencing this market shift, but it doesn't appear to be fueled by any of the insanity that happened before 2008.

Of course, let's all continue to keep a very close eye on things just in case.